Tuesday, 3 July 2012

Good-Bye Bob

Friday, 29 June 2012

Is It Time To Say Good-Bye?

Friday, 15 June 2012

The Falkland Islands Are British

Tuesday, 12 June 2012

What Is A Diamond Worth?

I still don't know how much Bob Diamond at Barclays Bank is paid. It is a fascinating subject since the question and its answer is symptomatic of all our questions about bankers' pay. A report on the Citywire Money page today tells us that in 2011 about 25% of the CEOs in FTSE100 companies enjoyed remuneration increases of an average of 41%. This seems spectacularly good, when most of these companies performed rather poorly and, of course, we are all in this together. Bob Diamond was at the top of the list with what was described as a "total realisable remuneration" of £20,971.000 — which seems not too bad in these straightened times. But the total, apparently, does not include “deferred bonuses awarded in the year and the expected value of share options and other share plan awards in the year, but includes instead the amounts realised from LTIPs and deferred share schemes that vest in the year, plus gains on options exercised in the year. These amounts realised are from awards made in earlier years.”

So, is there more to come or next year will he only get £15 million? And, does this total include any amounts paid to clear personal tax liabilities in the USA? And how much will he have tucked away in share options for when he leaves? Assuming that Mr Diamond pays tax on all of this income — which is almost certainly untrue — then George Osborne's reduction in the top rate of tax from 50p to 45p will reduce his tax burden by £1,041,050. I know dear Bob — like the rest of us — was struggling to make ends meet and was anxious to move on from all the discussion about bankers' pay, but this is ridiculous. Is it any wonder that the coalition government is falling out of favour when nonsense like this is allowed to happen. Barclays Bank is a big company but its performance has been terrible. Its shares are worth little more than than they were donkeys years ago and are at only about 25% of their pre-crash values. Dividends are no good either. There are no very good reasons at all for investing in Barclays and I suspect that many leave their money there in the hope that one day the shares will recover their value. In the meantime Bob Diamond carries on paying himself buckets of money for his expertise. I suppose he must argue that if he were not so absolutely brilliant the company would be in an even worse mess. They could be in a Spanish mess.

/

Monday, 11 June 2012

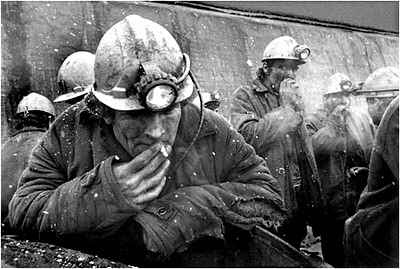

The Resurrection of Coal

Thursday, 7 June 2012

What Next For Europe

Saturday, 2 June 2012

A Summer Of Sport

Thursday, 31 May 2012

The End Is Nigh

Goodbye And Good-Luck Jussi

Buddy, Can You Spare A Dime?